How Does Property Transfer At Death?

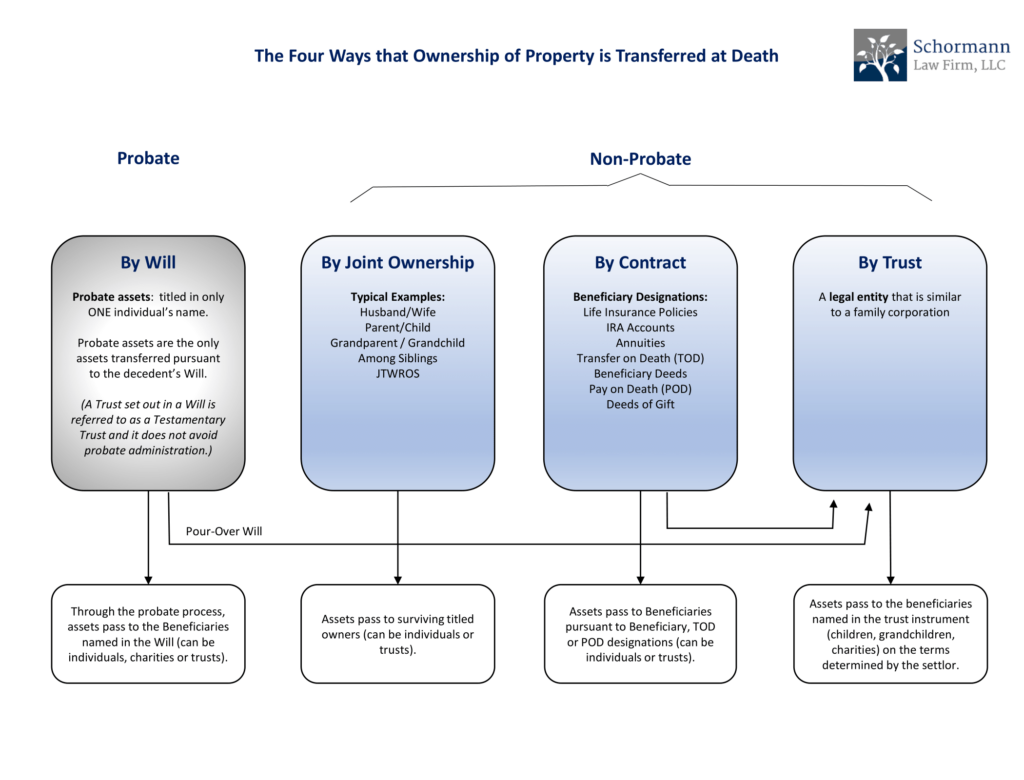

Most people think of the last will and testament as the way they pass down their estate to their loved ones, favorite charities and other parties. While bequeathing assets through the will is an option, it is not the only way estate administration works in Missouri. There are four ways of transferring ownership of bank accounts, real estate, retirement savings and other valuable property after death.

By Will

The testator can use their will to designate what will happen to the assets in their estate after they pass away. Items transferred this way must pass through probate first, which can take time and potentially expose the estate to the federal estate tax. Even assets designated to be transferred into a trust after you die do not avoid probate. This is called a testamentary trust, and assets being passed into it are still subject to oversight by the probate court.

By Trust

A trust is a legal entity allowed to own property. Assets placed in trust are managed by a trustee for the benefit of another party or parties, which can be your family or a favorite charity. There are several types of trust you can create in your lifetime that help you pass on assets and avoid probate. Each type of trust has its own advantages and drawbacks.

By Joint Ownership

Items you own jointly with another party automatically pass to them when you die. A common example is the family home. If you jointly own the house with your spouse, the surviving spouse will assume sole ownership upon the other’s death. You can also set up joint ownership with a trust.

By Contract

Several things associated with estate planning operate outside the estate administration process when the testator passes away. For example, a life insurance policy pays out to the beneficiary or beneficiaries designated in the policy, with no involvement from probate. Other assets that get transferred by beneficiary designation on a contract include:

- IRA accounts

- Annuities

- A transfer on death (TOD) or beneficiary deed that transfers real estate upon the current owner’s death

- A deed of gift, which works like a beneficiary deed but for personal property such as jewelry, furniture and artwork

One of these or a combination of two or more could be the best way to bequeath your hard-earned assets. One of our St. Peters estate planning lawyers will help you create a customized estate plan or assist with amending an existing plan so you can be confident that your final wishes will be honored with minimal cost and delay.

Work With Us For The Ideal Estate Plan

Schormann Law Firm, LLC, is ready to help you create the right estate plan for you and your family. For an appointment, contact us at 636.875.7653.